From retirees to business owners and everyone in between, tax filing season is hectic for basically every single person you know. If learning about tax filing horror stories fills you with concern, you might be happy to know that the process is quite simple. You just have to learn the basics of tax filing to follow the dos and avoid the don’ts.

To help you stay on top of this mandatory process, here is a quick guide on filing your taxes in 2024.

Learn About the Tax Filing Deadline

Before you start following the tax filing process like going through a guide to loan applications, make it a point to learn the tax filing deadline for the year. For 2024, the Internal Revenue Service (IRS) started accepting tax returns from January 29, 2024. For most taxpayers, the last day to file taxes is April 15, 2024. By remembering these dates, you can make sure to stay on top of the process and file your taxes on time.

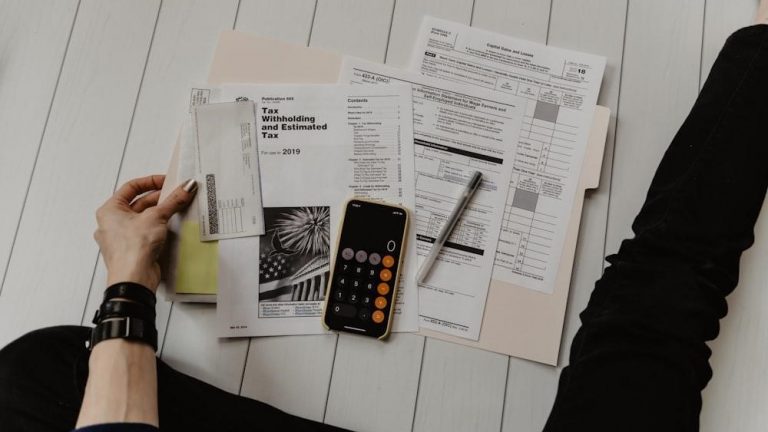

Gather Your Paperwork

The next step is making sure that you have all your paperwork in place. This helps you remain accurate in your tax details while filing your taxes, whether you do that yourself or hire someone to submit them with Intuit Accountants software. With that, it also lets you figure out if you must file taxes. But here’s the deal: Even if it’s not necessary, you should file your taxes to make use of possible tax refunds and credits.

Pick Your Filing Status

If you use a service like the Honeydue budgeting app, you might be aware of the changes that come with managing your finances as a couple. This also holds for tax filing. By considering the pros and cons of filing your taxes with your spouse, as well as choosing your status as the head of household or a widowed person, you can determine which filing status suits you the most. You can also discuss this with your tax accountant.

Check Your Withholding

If you work for someone, you might be familiar with the practice of tax withholding. This is where your employer deducts your taxes before giving you your paycheck. In many cases, your annual withholding is higher than your tax bill. But in other situations, it can be lower as well. By checking your withholding, you can know what to expect with your tax filing. This also helps you maintain some amount for tax bills in places like the Evergreen checking account.

Consider Tax Credits

While filing your taxes, one of your primary goals is to lower your tax bill as much as possible. This is where tax credits like child care and solar energy credits come into the picture to reduce your overall tax bill. In some cases, this reduction can decrease your tax bill to zero. This can be particularly helpful for you if you earn a portion of your income by forex and cryptocurrency investments that can hike up your tax bill to significant amounts.

Decide How to File Your Taxes

Once you have all the other details in place, it’s time to decide how you would like to file your taxes. While you can mail your tax documents to the IRS, this is not preferred by the agency itself due to the risks of lost or delayed mail. Instead, the IRS advises that you file your taxes online. If you have used solutions like the SoFi banking app, you can easily use this type of tax software.

Make Your Payments If Required

After filing your tax returns, you will be able to see if you owe any taxes to the government. If you follow forex trading strategies for survival, you might already know that digital payments are the fastest way to receive funds from creditors. This is also true for taxes, where online methods are the fastest way to make your payments. Similarly, if you expect any refunds, setting up direct deposits helps you receive them without excessive delays.

By following these tips, you can navigate the maze of tax season without stressing yourself out. This makes sure that you can fulfill this important responsibility without an impending sense of dread.